how to determine tax bracket per paycheck

The first 9950 is taxed at 10 995. For instance a tax system may tax 10 on the first 10000 of income 20 on the next 15000 of income and 25 on all other income.

Mathematics For Work And Everyday Life

That 85000 happens to fall into the first four of the seven tax brackets meaning that portions of it are taxed at different rates.

. On 50000 taxable income the average federal tax rate is 1510 percentthats your total income divided by the total tax you pay. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. Therefore 22 X 9 874 2 17228.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Discover Helpful Information and Resources on Taxes From AARP. Figure the tentative withholding amount.

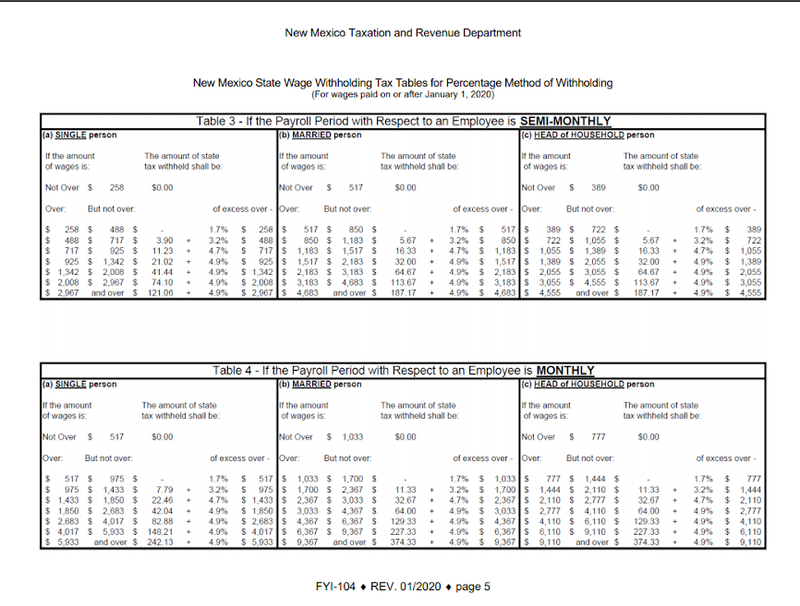

69400 wages 44475 24925 in wages taxed at 22. Enter the employees total taxable wages for the payroll period on line 1a. If your itemized deductions are less than the standard deduction just claim the standard amount.

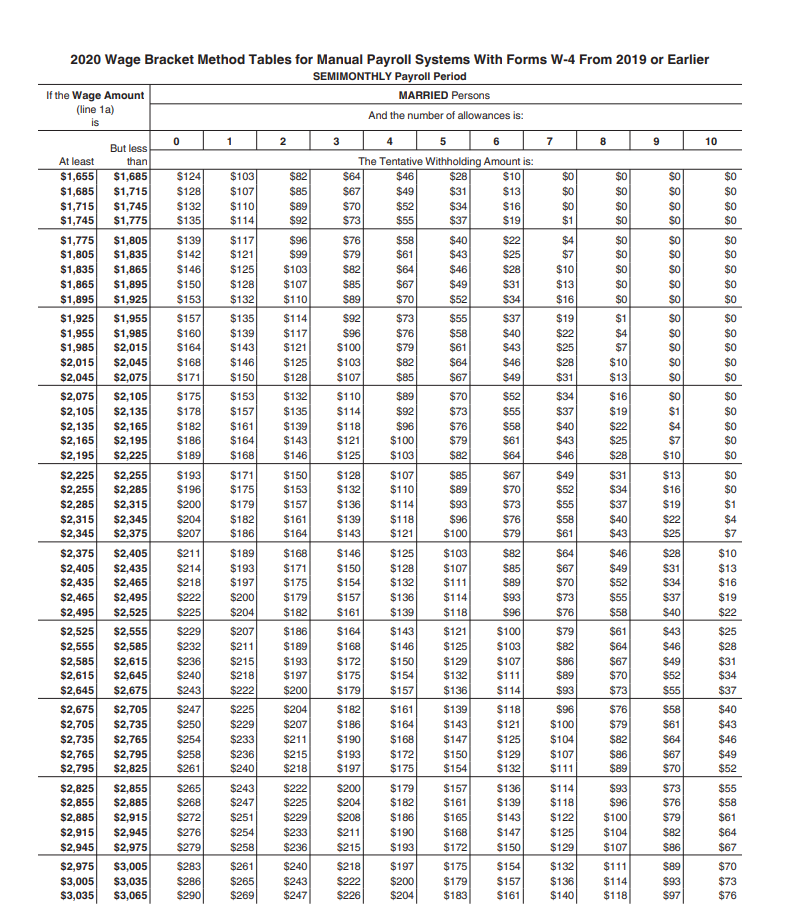

Check Form W-4 to determine whether the employee files income tax as married or single and the number of allowances they claim. The result is net income. 12 on the next 30575 40525-9950 22 on the remaining 9475 50000-40525 Add the taxable amounts for each segment 995 3669 2085 6749.

Make sure you have the table for the correct year. If we add up the two tax amounts. Up to 65000 that would be 561528.

Essentially your total tax bill will be 9875 3 62988 2 17228 6 78966. The next bracket is 9701-39475 and it is taxed 12 to give us an additional 357288. Its important to note that there are limits to the pre-tax contribution amounts.

There are seven federal tax brackets for the 2021 tax year. 10 on the first 9950 of taxable income. For example if you earned 100000 and claim 15000 in deductions then your taxable income is 85000.

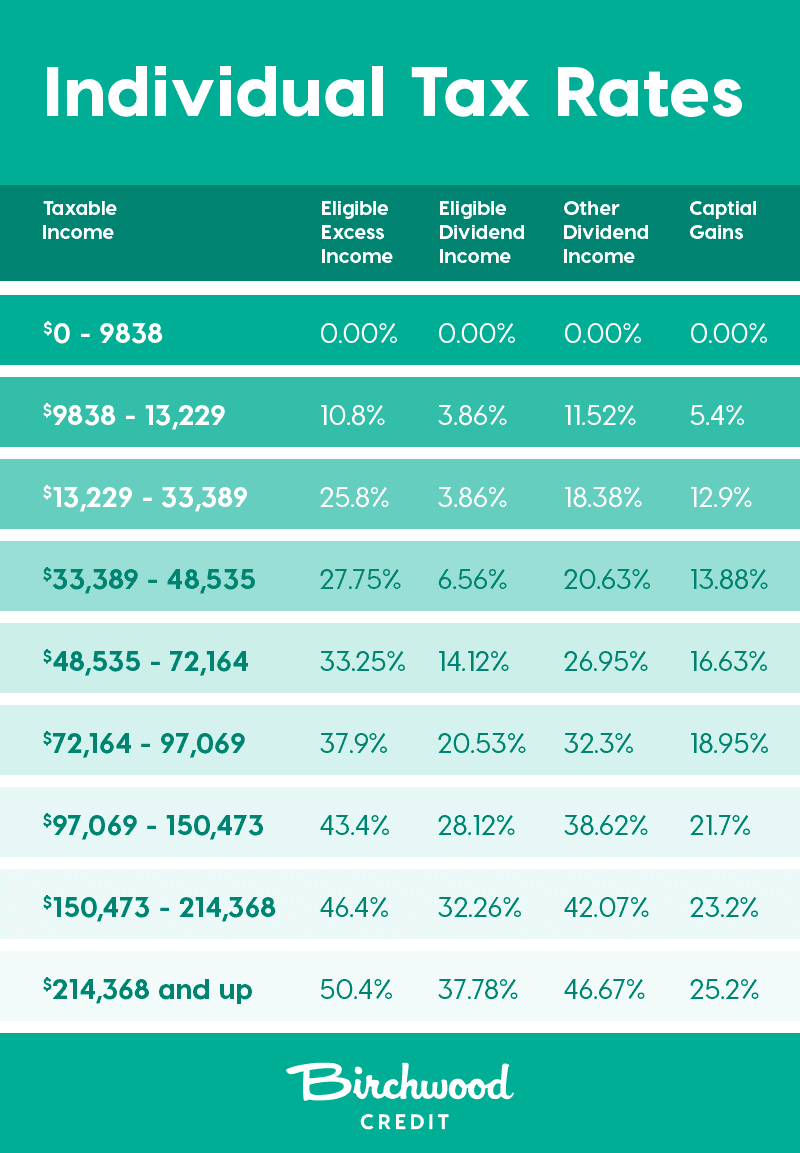

The bracket you land in depends on a variety of factors ranging from your total income your total adjusted income filing jointly or as an individual dependents deductions credits and so on. There are seven federal income tax rates in 2022. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above 539900 for single filers and above 647850 for married couples filing jointly.

However your marginal federal tax rate is 205 percentthats the tax rate you pay on anything you earn beyond your current earnings. Calculate your annual tax by the IRS provided tables. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

For 2021 tax returns Sarah will pay 6749 in tax. Keep in mind that the Tax Withholding Estimators results will only be as accurate as the information you enter. The employees W-4 form and.

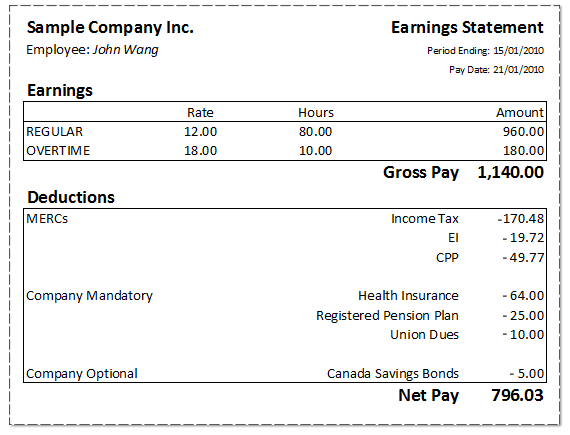

Adjusted gross income Post-tax deductions Exemptions Taxable income. How to calculate taxes taken out of a paycheck. Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widower.

Have your most recent income tax return handy. Average tax rate Total taxes paid Total taxable income. A tax rate of 22 gives us 50 000 minus 40 126 9 874.

0 - 9875 9876 - 40125 40126 - 85525 85526 - 163300 163301 - 207350 207351 - 518400 518401. To calculate Federal Income Tax withholding you will need. Because the employees tax situation is simple you find that their adjusted wage amount is the same as their biweekly gross wages 2025.

For 2022 the limit for 401 k plans is 20500. 10 12 22 24 32 35 and 37. 4664 548350 1014750 total.

The employees adjusted gross pay for the pay period. How to calculate annual income. The rest of your income is in the next bracket and is taxed 22.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. If you increase your contributions your paychecks will get smaller. Ad Compare Your 2022 Tax Bracket vs.

Your marginal tax rate or tax bracket refers only to your highest tax ratethe last tax rate your income is subject to. The total tax bill for your tax bracket calculated progressively is the tax rates per tax bracket. 2020 Federal income tax withholding calculation.

Subtract 12900 for Married otherwise subtract 8600 for Single or Head of Household from your computed annual wage. A copy of the tax tables from the IRS in Publication 15. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Income falling within a specific bracket is taxed at the rate for that bracket. How to Figure Out Your Tax Bracket.

The next 30575 is taxed at 12 3669. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Calculate Federal Income Tax FIT Withholding Amount.

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. You can calculate the tax bracket you fall into by dividing your income that will be taxed into each applicable bracket.

In this case lets say you have 45000 of. Gather information for other sources of income you may have. In addition you need to calculate 22 Column D of the earnings that are over 44475 Column E.

Enter your tax year filing status and taxable income to calculate your estimated tax rate. These ranges are referred to as brackets. For post-tax deductions you can choose to either take the standard deduction amount or itemize your deductions.

For example in 2021 a single filer with taxable income of 100000 will pay 18021 in tax or an average tax rate of 18. Gather the most recent pay statements for yourself and if you are married for your spouse too. The table below shows the tax brackets for the federal income tax and it reflects the rates for the 2021 tax year which are the taxes due in early 2022.

This includes any earnings an employee pays taxes on including salaries and cash tips. Your 2021 Tax Bracket to See Whats Been Adjusted. Your bracket depends on your taxable income.

Earned income income you receive from your job s is measured against seven tax brackets ranging from 10 to 37. This is 548350 in FIT. Your taxable income is the amount used to determine which tax brackets you fall into.

The last 5244 is taxed at 22 1154.

How Much Tax Is Taken Off My Paycheck In Alberta Cubetoronto Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Tax Calculator For Wages Hot Sale 53 Off Www Santramonsagratcor Cat

Tax Calculator For Wages Hot Sale 53 Off Www Santramonsagratcor Cat

Free Online Paycheck Calculator Calculate Take Home Pay 2022

What Percentage Of Taxes Are Taken Out Of Paycheck In Nova Scotia Cubetoronto Com

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

Paycheck Calculator Online For Per Pay Period Create W 4

How Much Tax Is Taken Out Of My Paycheck In New Brunswick Cubetoronto Com

Payroll Tax What It Is How To Calculate It Bench Accounting

2021 2022 Income Tax Calculator Canada Wowa Ca

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll Taxes For Your Small Business The Blueprint

How To Calculate Payroll Taxes For Your Small Business The Blueprint